Environmental regulations and standards are becoming increasingly stringent across the globe, and adherence to these requirements is essential for financial institutions, particularly banks and insurance companies, to manage their risk exposure. Environmental engineering firms play a vital role in assisting these financial entities in navigating the complex landscape of environmental compliance. Environmental engineering firms can aid banks and insurance companies in meeting environmental regulations and standards in different jurisdictions and markets.

Phase I and Phase II Environmental Site Assessments (ESAs)

A Phase I Environmental Site Assessment is a preliminary investigation conducted to evaluate potential environmental risks associated with a property or site. Typically performed by environmental engineers, this assessment is an essential step in the due diligence process before property acquisition or financing. If the Phase I ESA identifies potential environmental concerns, further investigation through a Phase II ESA may be recommended to confirm the presence and extent of contamination.

By analyzing data uncovered in a Phase I and Phase II ESA, environmental engineers can provide an accurate evaluation of the environmental risks and opportunities associated with a particular property or site. This valuable information helps financial institutions make informed decisions about lending or insuring ventures in compliance with applicable regulations.

Due Diligence and Risk Analysis

To safeguard their investments, banks and insurance companies need a clear understanding of the environmental risks associated with a borrower or an insured property. Environmental engineering firms conduct comprehensive due diligence and risk analysis to assess the environmental compliance history and potential liabilities of potential clients or projects.

By evaluating past environmental performance, compliance records, and regulatory issues, environmental engineers enable financial institutions to identify potential red flags and make informed decisions about lending or insuring specific projects or clients.

Regulatory Compliance and Permitting

Navigating the labyrinth of environmental regulations and permitting processes can be challenging, especially when financial institutions operate in diverse markets and jurisdictions. Environmental engineering firms possess in-depth knowledge of local, regional, and national environmental regulations, ensuring banks and insurance companies comply with all applicable laws.

These firms assist in securing the necessary permits and approvals for projects, enabling the financial institutions to conduct business smoothly while minimizing the risk of legal and financial repercussions associated with non-compliance.

Environmental Management Plans

Banks and insurance companies that have substantial investments in environmentally sensitive industries or projects require robust environmental management plans (EMPs) to mitigate potential risks and demonstrate responsible stewardship to stakeholders.

Environmental engineering firms work closely with these financial entities to develop tailored EMPs that outline specific measures to address environmental risks and meet regulatory requirements. These plans encompass strategies for pollution prevention, waste management, habitat conservation, and environmental monitoring to ensure ongoing compliance throughout the project’s lifecycle.

Sustainable and Green Initiatives

In today’s environmentally conscious society, financial institutions are increasingly expected to support sustainable and green initiatives. Environmental engineering firms assist banks and insurance companies in identifying environmentally friendly investment opportunities and projects that align with their commitment to corporate social responsibility.

By participating in environmentally sustainable projects, financial institutions not only promote a positive public image but also tap into markets where green investments are in high demand, potentially leading to long-term profitability.

Insurance Risk Assessment

For insurance companies, environmental engineering firms conduct detailed risk assessments for insured properties and projects. By evaluating environmental vulnerabilities, such as climate change risks, natural disasters, or pollution potential, these firms help insurance companies tailor their policies and pricing accordingly.

Moreover, environmental engineering firms assist insurers in understanding the financial implications of potential environmental claims and liabilities, allowing them to set appropriate premiums and reserves to manage risk effectively.

Conclusion

Environmental engineering firms serve as valuable partners to banks and insurance companies in navigating the intricate web of environmental regulations and standards across diverse markets and jurisdictions. Their expertise in environmental assessments, due diligence, regulatory compliance, and risk analysis empowers financial institutions to make informed decisions, manage environmental risks, and align their investments with sustainable practices.

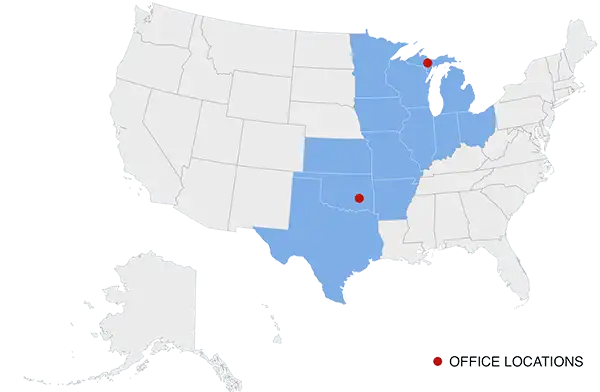

Arrowhead Environmental Engineering, LLC is a qualified, licensed engineering firm with extensive experience working with banks, insurers, and property developers.

Contact us and let us help you with your project.